June was the third month this year when hedge funds posted negative results. This clearly indicates that a prolonged period of stability we witnessed last year is over and investors are becoming extremely cautious seeing an unprecedented escalation of rhetoric regarding a potential trade war between the USA and key global trading partners.

In June the HFRI Fund Weighted Composite Index posted a decline of -0.45% leaving the YTD gains at only 0.78%. The results came in mixed as a range of returns among main strategies varied from -0.85% to +0.74%.

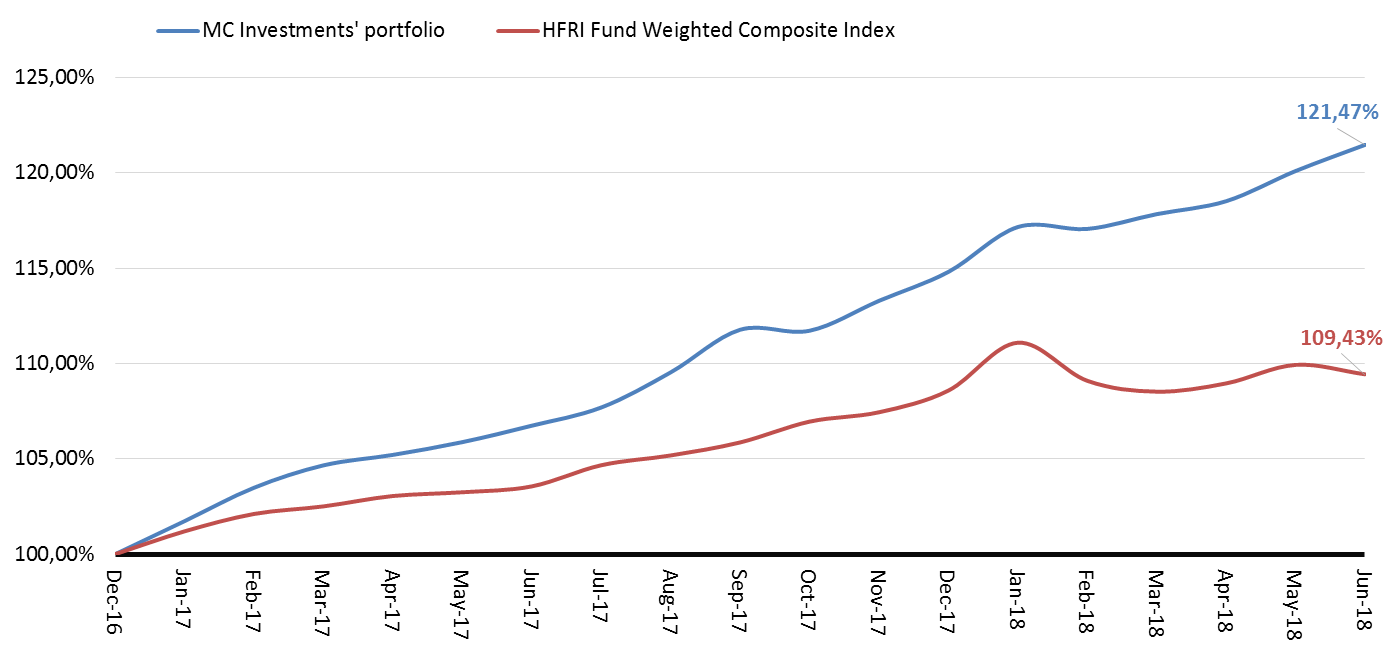

On the other hand, June was a very solid month for MC Investments’ top picks as our portfolio advanced by 1.14% for the month. Since the beginning of 2017 our selected funds have already returned 21.47% compared to 9.43% gains posted by the HFRI Index.

1 picture. Cumulative returns of HFRI Index and MC Investments’ portfolio since the beginning of 2017

Source: HFRI Indices, MC Investments

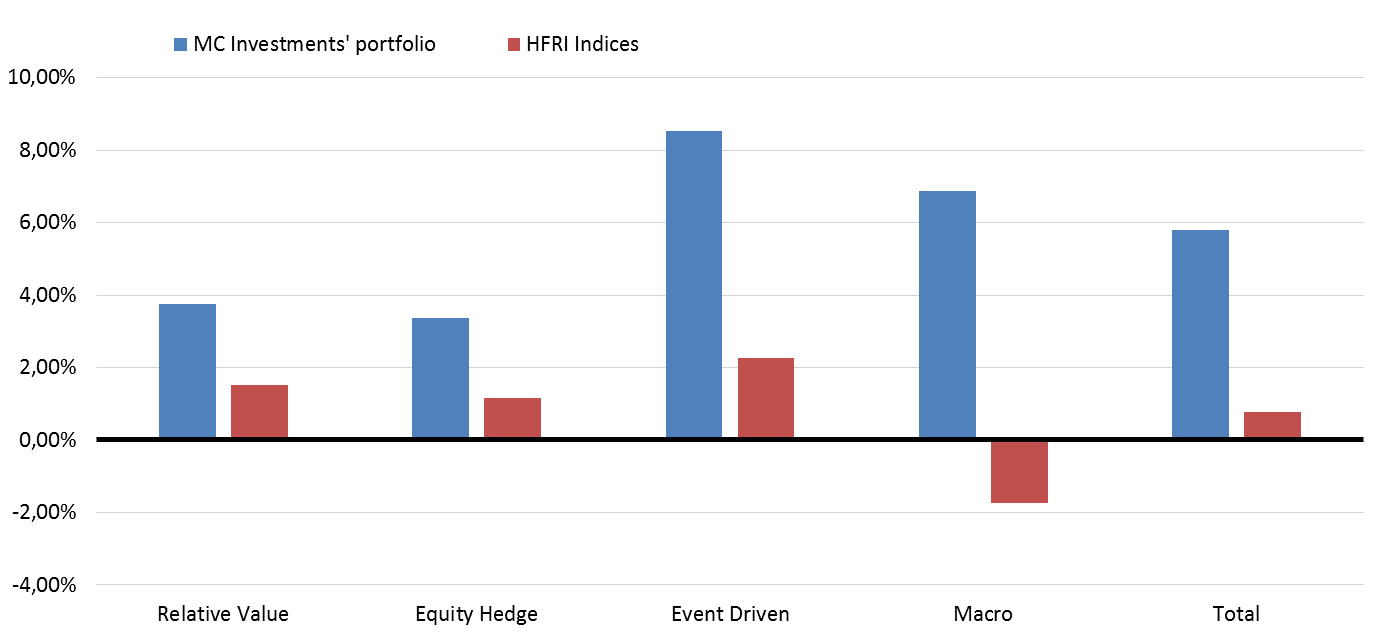

YTD gains of our portfolio have reached 5.80%, which translates into 5.02 p.p. excess margin over the HFRI Index (+0.78%). On the month to month basis, there was only one month this year when our funds posted a slight decline (-0.09% vs. the HFRI -1.80% in February) and only one month when the HFRI returns topped the gains of our portfolio (+2.05% vs. +2.31% gains in the HFRI Index back in January). Not surprisingly, as the chart below shows our funds maintain decent excess margins in every single strategy over the respective HFRI indices in YTD terms.

2 picture. YTD performance of HFRI Indices and MC Investments’ portfolio by strategies

Source: HFRI Indices, MC Investments

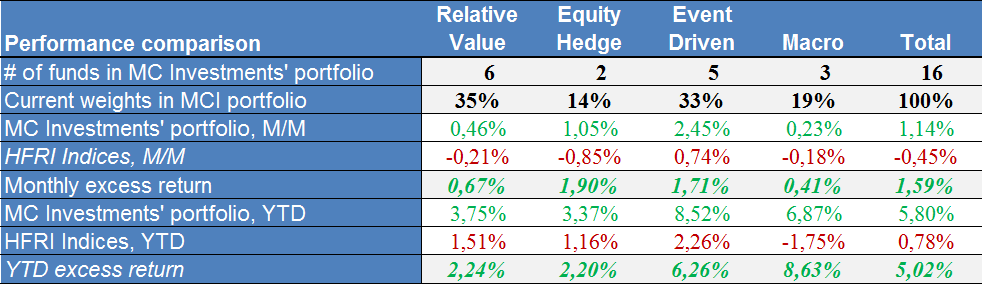

While there was only one strategy with positive returns in June based on the HFRI Indices, all strategies were profitable for our selected funds:

- The HFRI Relative Value Index posted a narrow decline of -0.21 for June, paring its YTD gain to +1.51%. Our selected funds returned 0.46% which has raised the YTD returns to 3.75%. Life settlement and credit exposed funds were our best performing funds under the RV strategy in June.

- Based on the HFRI data, Equity Hedge was the worst performing strategy for the month declining by 0.85% in June and pairing the YTD gains to 1.16%. If the beginning of 2018 might have seemed as yet another year with steady gains, the mood have completely reversed since then. The HFRI Equity Hedge Index have been fluctuating back and forth over the last few month with no clear direction. In contrast, our selected funds began the year somewhat unconvincingly but started to accelerate and are now up by 3.37% for the year (+1.05% in June).

- The Event Driven strategy funds were the only ones posting positive returns based on the HFRI Event Driven Index (+0.74% in June). The June gain brought 1H18 performance to +2.26%. An accelerated speculative activity in Media and Telecom sectors were named as a primary reason behind such performance. Our selected funds performed strongly posting 2.45% gains and lifting YTD returns to 8.52%.

- The HFRI Macro Index lost 0.18% in June and remained the only strategy with negative YTD returns (-1.75% YTD). One interesting trend is that large macro funds continued to outperform smaller peers. The same was true for MC Investments’ selected funds, which, on the other hand, delivered +0.23% returns. The YTD gains of our selected macro funds remained high at 6.87%, which translates into 8.63 p.p margin over the HFRI Macro Index.

1 table. June and YTD performance of HFRI Indices and MC Investments’ portfolio by strategy

Source: HFRI Indices, MC Investments

MC Investments’ portfolio had a very strong month in June without any signs of slowing down. One again, this emphasizes that being selective is very important, however, it requires specialized skill-set, know-how, case by case driven experience and unfaltering judgement. Get in touch to see how MC Investments can help you optimize the performance of your portfolio.