In the US, the S&P 500 ended a strong year with a fourth-quarter gain of +6.1%. Equity markets reached record highs on anticipated earnings growth which was mainly attributable to the US tax reform and projected easing of financial regulation. Generally positive macroeconomic data was also supportive for US equities: Q3 US GDP growth was better than expected, unemployment rate over the period remained low at 4.1%, while FED has lifted interest rates in December and raised its growth forecast up for 2018. Meanwhile, the VIX Index, a widely used measure of expected stock market volatility, fell more than 20% in 2017, reaching an all-time low in November.

European equities have underperformed several other markets in local currency terms. It is obvious, that European companies haven’t experienced the same boost from US tax cuts. The limiting factors were profit taking and strong Euro. There was little help from economic data showing continuing recovery in the single currency area. The unemployment rate fell to 8.7% in December, the lowest rate since 2009. Inflation was slightly accelerating giving the reason to anticipate that the ECB could end QE in September and even move with a first hike of its benchmark rate in the last quarter of 2018.

Astonishing performance of Japanese company earnings (which rose by 16% Y/Y in Q3) has resulted in a very strong quarter for Japanese equities (+8.7%). Japanese economy benefited from strong global growth and a pick-up in global trade. In addition, Prime Minister Shinzo Abe comfortably won the election in October, providing political stability and boosting confidence that there should be few changes to his economic policies. The unemployment rate declined to 2.7%, inflation data also unexpectedly improved while the survey of the Bank of Japan showed the strongest sentiment among large manufacturing companies for more than 11 years. Other Asian countries excluding Japan also did well as the MSCI Asia ex Japan index was up 8.2% in Q4 (strong gains were recorded in India, Korea and China).

Asia and the emerging markets could be named as the best-performing equity markets this year. Emerging market economies benefited from the weak dollar, the recovery in some industrial commodities prices and supportive political developments in countries like South Africa, Greece, India or China.

Inflows and launches

The prolonged appreciation in stock prices has raised uncertainty over equity markets and renewed confidence in the hedge funds. As a result investors’ demand to pull money from the sector in December 2017 was the lowest in a decade. Some argue that subdued redemptions at the end of last year could signal that investors still see value in hedge funds as a way to diversify investment portfolios amid the stock market rally that has continued into 2018.

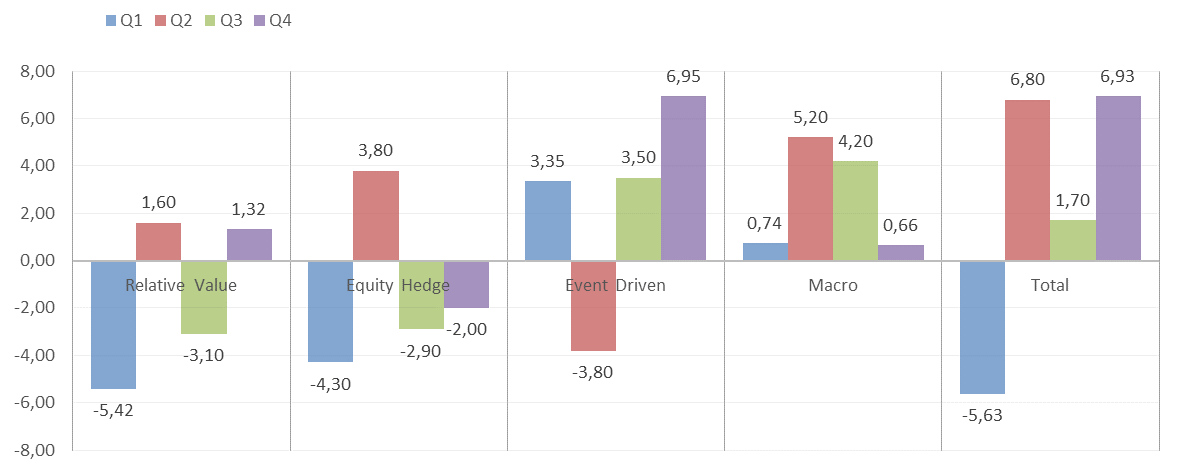

Positive attitude towards the sector has been backed by recently published data saying that investors allocated $6.9 billion of new capital to hedge funds in 4Q17 alone, the highest quarterly inflows since 2Q15, bringing total 2017 inflows to $9.8 billion. Inflows for Q4 were led by Event Driven strategies (+6.9b USD), which had benefited from an active M&A environment. Investors were also seeking Relative Value strategies allocating additional 1.3b USD. Growing demand for quantitative, trend following CTA funds resulted in Macro funds receiving 0.66b USD net inflows. Meanwhile, the need to reduce exposure to equity market have hurt Equity Hedge strategies which saw net outflows of 2.0b USD in Q4. Clearly, strong gains in both equity markets and EH hedge funds have urged investors to cash out redeeming some of their investments.

1 picture. Quarterly net inflows by strategy, in billion USD

Source: HFR

As noted in the recently published reports, the health of the hedge fund industry, which can be measured by the number of funds launched and liquidated, has improved in Q3 as well. According to the HFR Market Microstructure Report, new hedge fund launches exceeded liquidations on a quarterly basis for the first time in over two years, as improved investor risk tolerance and declining costs drove total hedge funds industry capital to a record of $3.16 trillion in 3Q17. Although the number of new launches was basically unchanged, the good sign was substantially decreased number of liquidations. It is very likely that such scenario has continued into Q4 as well. In addition, HFR team anticipates a continuation of this favorable trend in new launches pointing out Risk Parity and Risk Premia strategies, funds focused on Asian and Emerging Markets, Technology, Healthcare and Activism, as well as those specializing in Blockchain and Cryptocurrency being among the winners at least in the first half of 2018.

MC Investments keeps receiving a lot of inquiries from its business partners and investors for strategies that could further enhance their portfolios. For us the official inflows data did not come as a surprise as we could anticipate similar results just from analyzing actual interest. Among the most popular strategies investors were looking for were Relative Value (especially credit and niche strategies) and Event Driven. Macro funds were although sought but with a condition of being fully quantitative and absent of human intervention in decision making process. Equity Hedge strategies attained some interest as well. However, having in mind strong results in equity markets investors were very demanding seeking funds with only strong track record and able to outperform the main equity indices.

Hedge funds performance

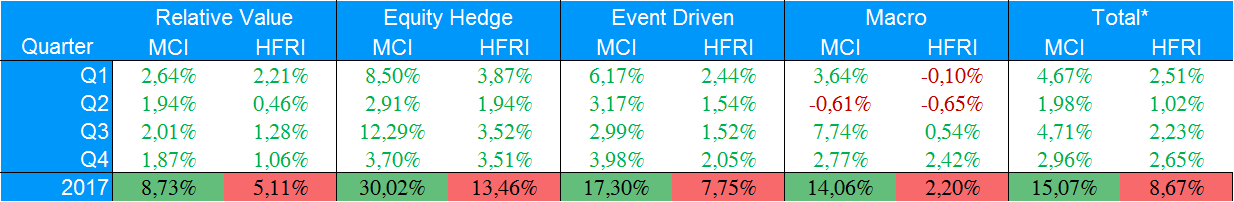

Hedge funds industry has finished the year with yet another strong monthly performance gaining 1.06% in December. It was an exceptional year absent of negative monthly results – the situation which is especially rare and was last seen back in 1993 and 2003. HFRI index advanced by 2.65% in Q4 bringing full year gains to 8.67%. MC Investments’ portfolio of selected hedge funds ended the year delivering even stronger gains of 2.96% and 15.07% for Q4 and 2017 respectively.

1 table. Quarterly performance of MC Investments’ selected funds and HFRI Indices

Source: HFRI Indices, MC Investments’ calculations

Quarterly performance by strategy was quite “boring” as only Macro strategies have recorded negative results. There were 2 negative quarters for HFRI Macro index with just 1 negative quarter for MC Investments’ selected Macro funds. All others strategies delivered only positive gains in each quarter.

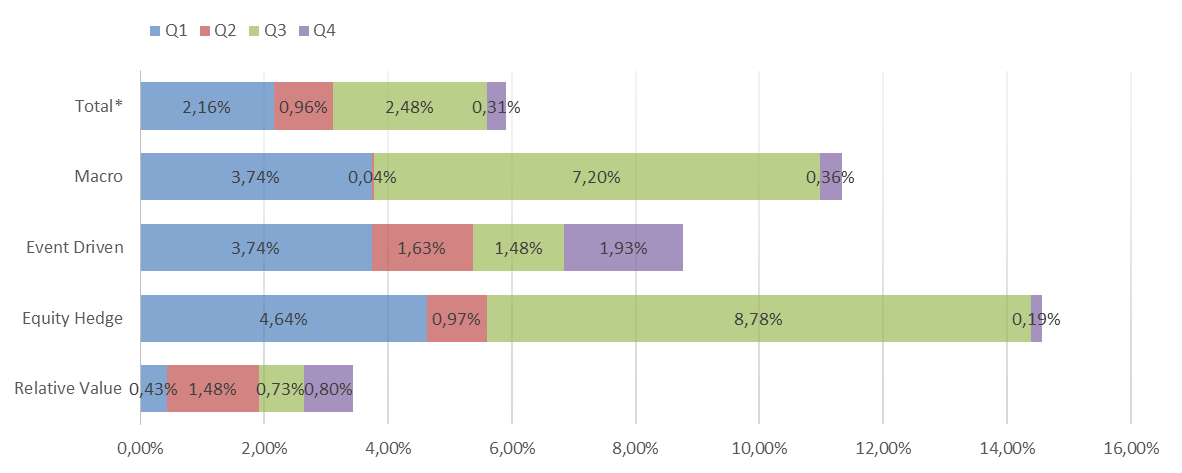

It is worth noting that our selected funds have beaten respective HFRI indices in every single quarter. Total excess return in 2017 was equal to 6.4 p.p. Equity Hedge and Macro funds were the most successful picks exceeding average hedge funds performance by 16.57 p.p. and 11.86 p.p respectively.

2 picture. Excess returns of MC Investments’ selected funds over HFRI Indices, in percentage points

Source: HFRI Indices, MC Investments’ calculations

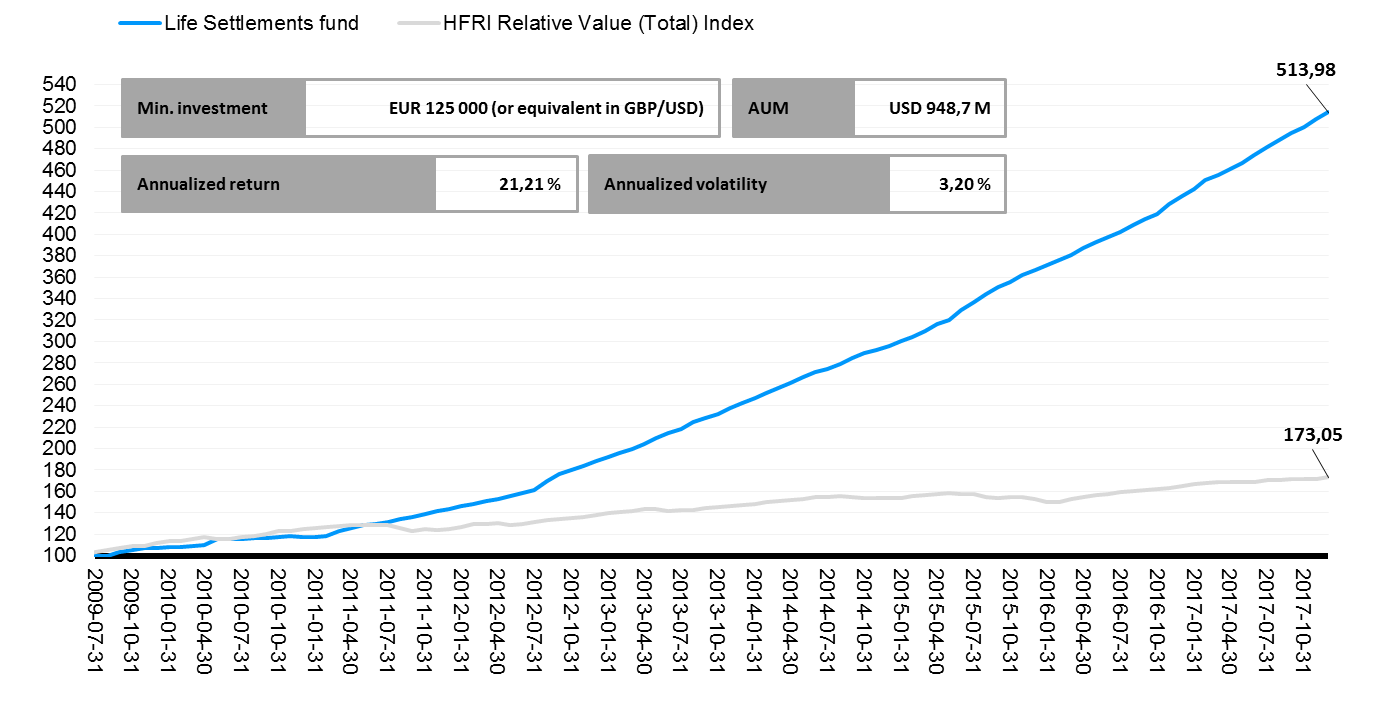

Our Top pick

Niche strategies such as life settlements or lending remain our favorites. Having low correlation with traditional asset classes and delivering steady positive returns our selected life settlement fund deserves to be named a top pick again. The fund clearly outperformed comparable HFRI Relative value fund and posted 1.27%, 3.90% and 17.94% gains for the month, Q4 and FY 2017 respectively. The Fund demonstrates continued stability with the annualized standard deviation of 3.20% since inception.

The life settlement industry has been enjoying steady growth in recent years and is projected to sustain that growth for the next decade. According to the Life Insurance Settlement Association, the industry is thriving today because a life settlement offers an attractive option for seniors who no longer want or can afford a life insurance policy, and the market for those transactions is safe and well-regulated. Institutional investors still lack some knowledge and education, but once it comes this asset class will definitely receive more and more attention.

Don't hesitate to get in touch should you wish to learn more about the Fund.

3 picture. YTD performance of Top pick fund vs. HFRI Relative Value Index

Source: HFRI Indices, MC Investments’ calculations

Articles you might be interested in

Hedge Funds Had a Good Year, Just Not Good Enough

Hedge Fund Sees Juice in Greek Rally as Yields Hit 2006 Low

The Outlook for Hedge Funds in 2018

The Lessons of 2017 for Hedge Funds

Agecroft Partners predicts top hedge fund industry trends for 2018

Hedge funds produce best returns in 4 years

2018 Blockchain and Cryptocurrency Outlook: Expert Blog

Quarterly Outlook - Q1 2018 by Saxo